Minister of Finance Lawrence Wong delivered Singapore's FY2022 Budget Statement, titled "Charting Our New Way Forward Together" on Friday, 18 February 2022.

Here, we discuss some main points of the Budget that impact you as a current or future property owner, as well as the way forward in light of these changes!

What has come out of Budget 2022, that impact current or future property owners?

1. Increase in property tax rates

Property taxes for both owner-occupied and non-owner-occupied properties will go up in two steps starting from 2023.

In Singapore, property tax is calculated based on the annual value (AV) of the property, multiplied by the applicable property tax rate. The AV is based on the estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees.

Increase for owner-occupied residential properties

For owner-occupied residential properties, the property tax rate will go up from 4 - 16% currently, to 5 - 23% from 1 Jan 2023, and then to 6 - 32% from 1 Jan 2024.

Increase for non-owner-occupied residential properties

For non-owner-occupied residential properties, the property tax rate will go up from 10 - 20% currently, to 11 - 27% from 1 Jan 2023, and then to 12 - 36% from 1 Jan 2024.

The increase is greater for non-owner-occupied residential properties with higher AVs. We could see a knock-on effect on rentals as landlords try to pass at least part of these costs on!

💡: If you would like to check the AV of your property, you can do so for free using IRAS's 'View Property Dashboard' digital service. To check the AV of a property you do not own, you can do so using its 'Check Annual Value of Property', at a cost of $2.50 per search.

2. Increase in the Goods & Services Tax (GST)

First announced in 2018 to take place sometime between 2021 and 2025, the timing of the increase in GST was confirmed during Budget 2022. From 7% currently, GST will increase to 8% from 1 Jan 2023, and then 9% from 1 Jan 2024.

Residential property is exempt from GST in Singapore. However, do note that many of the ancillary services and goods in buying and fitting out your new home are usually subject to GST. These include your renovation costs, purchase of white goods, etc.

Non-residential (e.g. commercial and industrial) property transactions are also usually subject to GST. If the vendor or landlord is GST-registered, the buyer or tenant will have to pay GST for the purchase or lease. A GST-registered buyer will be able to claim the GST paid back from IRAS. If you are not, you save 1% or $10k on a $1m commercial unit purchase signing on 31 Dec 2022 as compared to 1 Jan 2023!

3. NO broad-based or net wealth tax

One 'good news' out of the Budget was 'no news' - contrary to earlier market chatter, no broad-based or net wealth tax was implemented.

No doubt, a number of the changes tabled - the above-discussed increase in property tax rates and GST, as well as higher taxes on luxury cars and personal income taxes for those with income of over $500,000 - are clearly targeted high wage earners in Singapore. The personal income tax changes, for example, are expected to hit the top 1.2% of taxpayers.

However, Singapore is taking a very measured approach to imposing taxes on the wealthy, as Minister Lawrence Wong explained in an interview with CNBC. He noted: "We are not against people doing better, earning more and accumulating wealth - by no means, these are good things."

💡: A net wealth tax imposes a tax on individuals based on their net worth. An example is the Ultra-Millionaire Tax currently being proposed in the US, for wealthy households to pay a 2% tax annually on their net worth above $50m, and a 6% tax for every dollar above $1bn.

What else could come?

Singapore has a progressive tax system, and there are definitely signs that more taxes on the rich will come, albeit at a measured pace.

Post-Budget 2022, Minister Indranee Rajah highlighted that "The Singapore Government is committed to progressive taxes and transfer structures, and the wealth tax measures rolled out in this year's Budget are not 'the be all and end all of it'." Minister Lawrence Wong has also said that there is room for greater progressivity.

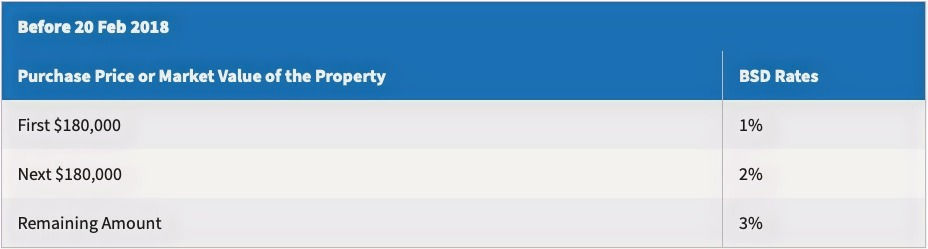

In recent cooling measures imposed on 16 December 2021, ABSD rates were increased almost across the board. But one rate has remained fairly low - the buyer's stamp duty (BSD). The BSD was last adjusted in Budget 2018, and was previously at up to 3%.

BSD: Pre-Budget 2018

In Budget 2018, this was tweaked to 4% for residential properties, for the purchase price or market value in excess of $1m. The BSD rates for non-residential properties remained unchanged.

BSD: Post-Budget 2018

It has been some time since this last change, and there is likely some room for upward adjustment. In the UK for example, where a stamp duty land tax (SDLT) is paid on purchases of property, the rate goes up to 12% for the property value that in excess £1.5 million, if after buying the property it is the only residential property owned. In Australia, rates differ by state. The highest tier is generally around 4 - 6%.

What to do?

The direction is clear - higher taxes and duties are coming. At the same time, the Singapore government is introducing these at a measured pace, mindful of the need to keep talents and the country an attractive place to stay and invest in.

A. Home buyers: Review and take action!

If you have been intending to buy a property, a number of things that have happened in recent months may have put you off, such as the cooling measures in December and the ongoing war in Ukraine. (Additional Reading: Crisis in Ukraine: What is the impact on Singapore Property?)

New home sales volumes have fallen, partly due to these uncertainties and partly due to less new home launches given low developer inventories.

However, the uptrend in prices has continued, with analysts projecting the market to rise around 1 - 4% in 2022, a more controlled pace that the government is more likely to feel at ease with for now.

If your intended purchase is purely an investment, it may be fine to hold off and take a gamble on your conviction that prices will fall. The worst that could happen is that you miss the current lull, and may have to find an alternative investment.

However, if you are looking to buy a property for your own stay, and you have done your sums to ensure you can afford the home, acting sooner can help you to avoid imminent higher costs such as the increase in GST, or any potential increase in stamp duties! (Additional reading: Singapore Budget 2022: Impact on Property Owners and Your Property Investments)

B. Property investors: Commercial and industrial properties worth a look

The idea of buying commercial and industrial properties is still foreign to many property investors, but it should be more of an area of focus going forward. 3 key reasons why:

1. Lower taxes and duties

ABSD is not applicable on commercial and industrial properties

The BSD (3% at the highest tier) is lower than for residential properties

The property tax rate (flat 10%) is unaffected by the increases proposed in Budget 2022 and will be lower than that of any non-owner-occupied property from 2023

2. Prices of commercial and industrial spaces have lagged residential

Between 2013 to 2021, private residential prices in Singapore have still risen about 15% despite severe cooling measures in 2013. On the other hand, commercial and industrial property prices have, on the whole, lagged significantly.

There are of course segment-specific supply and demand factors to consider. The office market, for example, is highly cyclical. The timing of new supply as new large skyscrapers get completed can also affect the market significantly.

It is important to study and know your target market well.

3. Rents steadying with economy continuing to rebound

With the Singapore economy continuing to rebound, rents have been steadying and improving for higher quality properties. Vacancy rates are now also starting to decline.

Singapore Grade A office rental and vacancy rate

As rents improve, the higher rental yield could certainly drive greater interest and capital appreciation for these assets.

This could be their time to shine!

Remember, with GST usually applicable on such purchases, you can save 1 - 2% investing early before the GST increases in 2023 and 2024.

Of course, this is not a call to run out and buy any random commercial or industrial property. There are definitely many factors to consider. Due diligence is a necessity!

About The Author

In her former life as an equity analyst, Evon analyzed companies and stocks to find the best ones for her investors to invest in, with over a decade of consistent outperformance. Now as a realtor, she enjoys using her analytical skills to help her client secure the best properties to invest in, and finds the greatest joy in journeying with clients towards their dream homes and ideal units.

Comments